does personal cash app report to irs

If you have a technical problem with the app you can call the companys main customer service number at 1-800-969-1940. WHAT WE FOUND On its website the Internal Revenue Service IRS writes that if a person steals property they must report its fair market value as income unless they return it to its rightful owner within the same year.

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Heres a quick guide to some of the forms that apply to each potential tax fraud situation.

. Under orders from President Biden the IRS is cracking down on payments Americans receive through third-party apps and is now requiring Venmo PayPal and Cash App to report transactions if they. Assets in conjunction with Form 1040 Schedule D Capital Gains and Losses to report capital gains and or losses on the sale of assets. The online payment giants have been told that from January 1 they must report commercial transactions of that value or higher.

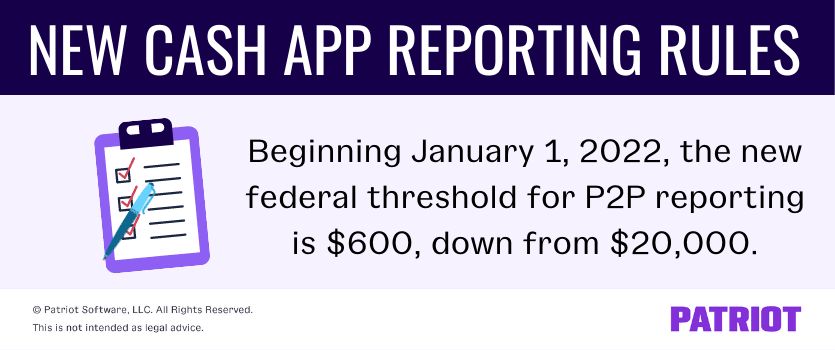

On it the company notes this new 600 reporting requirement does not apply to personal Cash App. VENMO PayPal Zelle and Cash App must report certain 600 transactions to the Internal Revenue Service under new rules. To report a business or individual mail or fax Form 3949-A.

But unlike premium tax software companies you wont have the option to upgrade to tiers that include access to tax pros. This lesson includes topics on the sale of stock mutual funds and the sale of a personal residence. An award isnt an item of tangible personal property if it is an award of cash cash equivalents gift cards gift coupons or gift certificates other than arrangements granting only the right to select and receive tangible personal property from a limited assortment of items preselected or preapproved by you.

The IRS website provides the forms you need to report different types of fraud. Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps. The IRS FreeFile program is the result of a long-standing political and legal compromise between large tax preparers such as HR Block and Intuit and the IRS.

You can mail or fax these forms to the IRS. This new rule does not apply to payments received for personal expenses The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such as Venmo Cash App or Zelle will now be reported to the IRS. 2 days agoPayPal Venmo and Cash App to report commercial transactions over 600 to IRS.

Squares Cash App includes a partially updated page for users with Cash App for Business accounts. On it the company notes this new 600 reporting requirement does not apply to personal Cash App. Instead it only pertains to Cash for Business accounts and applies only to payments received in 2022 US News.

Yes the IRS does require people to report income from stolen property and illegal activities. Squares Cash App includes a partially updated page for users with Cash App for Business accounts. News Venmo PayPal and Cash App will now have to report transactions totaling more than 600 to the IRS as Biden plans to ramp up financial enforcement Thread starter TangoTango Start date Jan 5 2022.

If the taxpayers have sold any other assets refer them to a professional tax preparer. Cash App does have a new dedicated Help Center for Cash App Taxes. The new 600 reporting requirement does not apply to personal Cash App accounts.

The IRS will not offer any free publically-funded tax software beyond Free Fillable Forms and in return these companies will make available free software versions of their cash cows to.

Earning Money On Paypal Or Venmo This New Irs Reporting Rule Might Apply To You Cnet

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York

Changes To Cash App Reporting Threshold Paypal Venmo More

New Rule To Require Irs Tax On Cash App Business Transactions Wbma

Changes To Cash App Reporting Threshold Paypal Venmo More

New Irs Rule For Cash App Transactions Set To Go Into Effect Next Year

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules